Medicare pays a portion of your health care costs for hospitalization, skilled nursing facility care and physician’s services and supplies. However, it does not pay all of your expenses and requires you to pay deductibles and coinsurance for many services. A Medicare supplement insurance policy can help pay some of the charges Medicare doesn’t cover.

What Medicare Supplements Do

• Pays some of the uncovered medical expenses that Medicare does not pay.

• Allows you to keep your doctors and see specialist without referrals.

• Guarantees your acceptance regardless of your health during your Medicare open enrollment period-no health questions asked.

Medicare Supplement Plans

The plans are the same among the companies offering Medicare Supplements, so the reasons to choose one company’s plans over another come down to:

Price – including premiums and any policy fees or discounts

Plan selection; plans may vary by state

Price stability-how often they have price increases

Experience offering and servicing Medicare supplements

Family Life Insurance Group is committed to finding top quality, “A” Rated carriers to meet your Medicare Supplement needs. We specialize in finding the lowest cost medicare supplement in your area.

FLIG will help you compare price and plans among providers in your area. Call us TODAY (404-233-3544) for a free analysis of the plans and cost of a Medicare Supplement or Medicare Advantage Plan for you, or use the form on this page to request a free analysis.

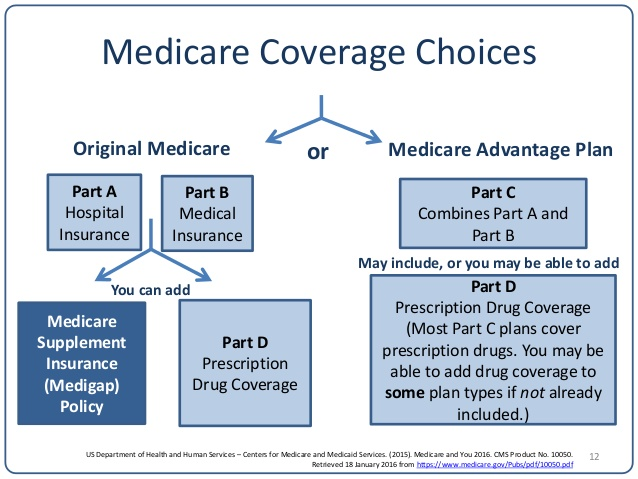

Medicare Supplement or Medicare Advantage?

What is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies provide all the benefits of Part A and Part B, with the exception of hospice care (that remains covered by Medicare Part A). These plans sometimes also include additional benefits, such as vision, dental, and/or prescription drug coverage. Note that people with end-stage renal disease (ESRD) generally do not qualify for Medicare Advantage plans. When you join a Medicare Advantage plan, you must continue paying your Part B premium.

Medicare Supplement Features

There are 10 standardized plans in 47 states, while Massachusetts, Minnesota, and Wisconsin each have their own plan offerings. Plans are categorized by letter—A, B, C, D, F, G, K, L, M, and N—and plans of the same letter offer the same benefits. However, insurance companies can offer plans at different prices; therefore, you may have different out-of-pocket costs, even if the standardized plan benefits are the same. These plans do not provide prescription drug coverage. This means that you will have to enroll in a stand-alone Medicare Prescription Drug Plan for medication coverage.

While Medicare Supplement plans help with deductibles and other expenses not paid by Original Medicare, they do not cover services if Original Medicare does not cover them. For example, they do not cover long-term care, dental care, or eye glasses.

How do I choose?

When deciding on a plan, it’s essential to compare the benefits and costs in relation to your specific health care needs. With Medicare Advantage plans, you must continue to pay your Part B monthly premium, in addition to the monthly premium for your plan. However, although Medicare Supplement plan benefits are standardized, costs can vary between plans with the same benefits and are generally more expensive.

When comparing the benefits and costs of plans in your area, be sure to take these key factors into consideration:

Deductibles

Monthly premiums

Anticipated costs of health care and hospital services you use often

Restrictions on doctors, hospitals, and pharmacies

Expected costs of prescription drugs that you require regularly

Maximum out of pocket amounts