Cancer & Stroke or Heart Attack Plans

Critical Illness plans pay a lump-sum cash benefit directly to you if you are diagnosed with a specified major illness such as a stroke, heart attack or cancer. In the past, these events may have triggered a life insurance policy. With the medical technology available today the survival rate after critical illness events has dramatically increased. Although we are surviving these events, they may leave us temporarily unable to work or generate income. A critical illness plan can mitigate the financial strain imposed by such events. As we age the chance of experiencing a critical illness dramatically increases. These plans will prepare you for such an event.

The cash benefit is paid directly to you to use any way you choose!

Choose from two plan types:

Cancer Plan

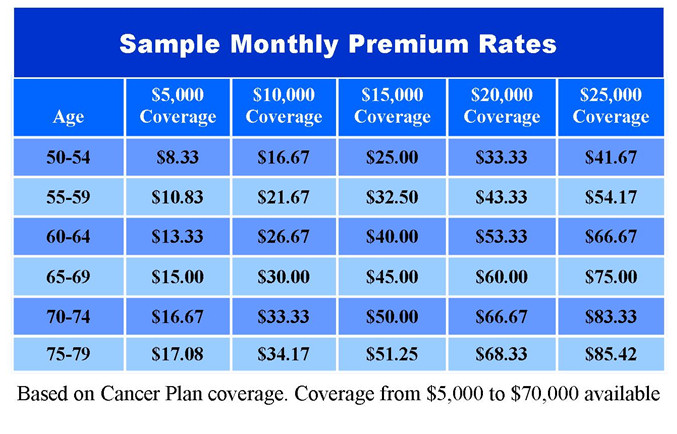

Pays a lump sum benefit from $5,000 – $70,000 upon first diagnosis of cancer.

Critical Illness

Pays a lump sum benefit upon diagnosis of:

- Heart Attack

- Stroke

- Cancer

- Alzheimer’s

- Organ Transplant