Retirement Planning

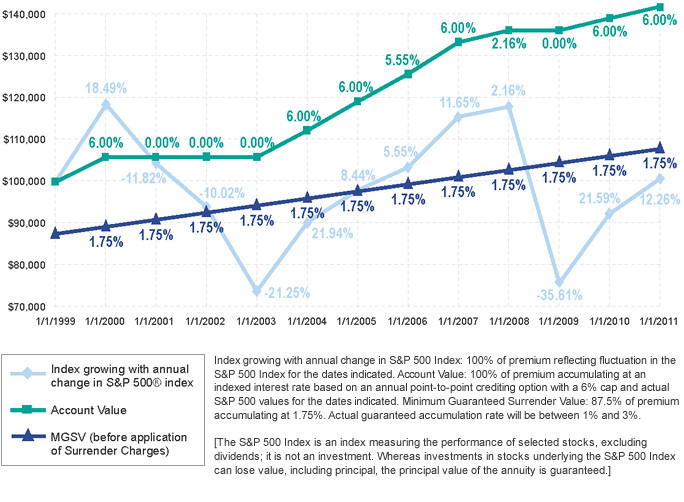

The following hypothetical example illustrates how the account value of a Fixed Index Annuity can increase but not decrease in value assuming no withdrawals and no surrender charges. It assumes a $100,000 premium. The example is not a representation of future performance.

The cash benefit is paid directly to you to use any way you choose!

An annuity is an agreement between you and an insurance company, where you accumulate your funds in a tax advantaged manner and can later receive a series of payments provided by the insurance company for a determined period of time, based on your needs.

Annuity Highlights

If you are in a saving-money stage of life, annuities can help you:

- Meet your retirement income goals.

- Manage and diversify your investment portfolio.

- Have different options.

- Benefit your heirs.

- Plan your estate.

If you are in a need-income stage of life, annuities can help you:

- Have a lifetime income.

- Protect against outliving your assets.

- Protect your assets from creditors.

- Diversify investment risk.

- Tax deferral on investment earnings.